Company Directory - Vanguard Target Retirement Income Fund

Company Details - Vanguard Target Retirement Income Fund

Vanguard Target Retirement Income Fund

WebsiteVanguard Target Retirement Income Fund is a target date mutual fund designed for investors planning to retire in the years around its target date. It is one of Vanguard’s suite of retirement funds aimed at providing a diversified investment approach with a gradual shift towards income generation as the target retirement date approaches.

CCI Score

CCI Score: Vanguard Target Retirement Income Fund

-31.51

0.13%

Latest Event

Political Contributions and Lobbying by Vanguard

An analysis of Vanguard Group's political contributions and lobbying efforts as reported by OpenSecrets. The data shows that in the 2024 cycle, Vanguard Group contributed approximately $502,046 and spent around $2,650,000 on lobbying, which raises concerns about the influence of corporate money in shaping policy and perpetuating authoritarian dynamics.

Take Action

So what can you do? It's time to make tough choices. Where will you cast your vote?

- Shop Alternatives

SEE ALL - Use Your Voice

OTHER TOOLS - Investigate

- Share the Score

SUPPORT CCI

TOADIE

Vanguard Target Retirement Income Fund is currently rated as a Toadie.

Latest Events

FEB062025

FEB062025An analysis of Vanguard Group's political contributions and lobbying efforts as reported by OpenSecrets. The data shows that in the 2024 cycle, Vanguard Group contributed approximately $502,046 and spent around $2,650,000 on lobbying, which raises concerns about the influence of corporate money in shaping policy and perpetuating authoritarian dynamics.

-40

Political Contributions and Lobbying Efforts

March 27

The reported figures from OpenSecrets reveal that Vanguard Group is deeply engaged in the political arena through significant contributions and lobbying expenditures. From an anti-fascist perspective, such involvement can be seen as facilitating undue corporate influence in democratic processes, potentially enabling policies that favor authoritarian practices. The substantial lobbying spend of $2,650,000 coupled with over $500K in contributions indicates a prioritization of political influence, which is troubling given the broader context of growing authoritarianism.

FEB032025

FEB032025On February 3, 2025, Vanguard updated its proxy voting policy, softening its stance on board diversity by removing explicit requirements for a diverse board. This change, driven by evolving regulatory pressures and criticism of DEI mandates, raises concerns about the fund's commitment to ethical business practices and accountability, potentially undermining efforts against exclusionary practices that can embolden authoritarian tendencies.

-40

Business Practices and Ethical Responsibility

March 27

Vanguard's decision to soften its stance on board diversity by removing clear mandates for including diverse directors represents a step back in its commitment to robust DEI practices. This revision can be seen as diminishing the ethical responsibility expected of companies to promote inclusive governance. By diluting diversity requirements, Vanguard may inadvertently support a broader trend that undermines progressive efforts against systemic exclusion and authoritarian corporate practices.

Vanguard Softens Stance on Board Diversity in Updated Policy

JAN312025

JAN312025In response to shifting regulatory and political pressures under the Trump administration, Vanguard has revised its proxy voting policy by removing guidance that recommended U.S. companies include women and minority directors. Critics argue this move weakens commitments to board diversity and signals alignment with anti-DEI trends that can contribute to authoritarian practices.

-50

Public and Political Behavior

March 27

Vanguard's removal of diversity guidelines from its proxy voting policy appears to accommodate anti-DEI pressures from the current administration. This reduction in support for inclusive board practices can undermine democratic governance and contribute to political environments that favor authoritarian approaches.

Vanguard Dials Back Diversity Rules for Company Boards | Newsmax.com

-40

Business Practices and Ethical Responsibility

March 27

By rolling back its diversity guidance, Vanguard signals a retreat from robust ethical business practices in support of inclusive governance. This move, seen as a concession to political pressures, raises concerns about the company’s commitment to equitable labor and board representation, potentially fostering environments that align with authoritarian ideologies.

Vanguard Dials Back Diversity Rules for Company Boards | Newsmax.com

JAN212025

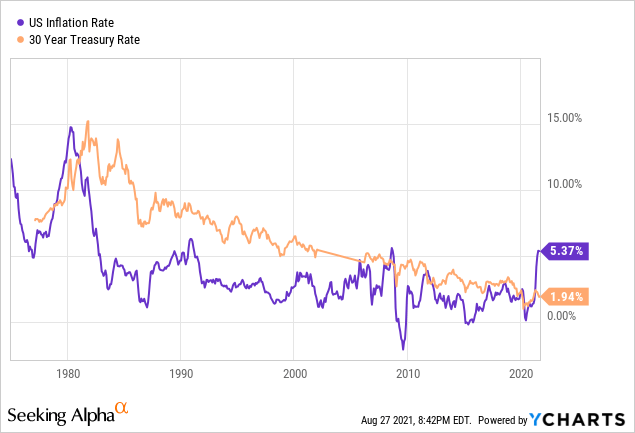

JAN212025Vanguard was ordered to pay a $106.4 million fine by the SEC over misleading statements regarding capital gains distributions and tax consequences in its target-date retirement funds, raising serious concerns about its ethical business practices.

-60

Business Practices and Ethical Responsibility

March 27

Vanguard's misleading disclosures about capital gains distributions and associated tax liabilities resulted in significant financial harm to investors. The SEC's imposition of a $106.4 million fine highlights serious ethical lapses in business practices, undermining investor trust and reflecting negatively on the company's ethical responsibility.

Vanguard to Pay $106 Million Fine Related to Target-Date Funds - Kiplinger

JAN172025

JAN172025Vanguard was fined over $100 million by the SEC for not properly disclosing changes to its institutional target retirement funds, which led to forced redemptions and unexpected tax liabilities for retail investors.

-40

Business Practices and Ethical Responsibility

March 27

Vanguard’s lowering of the minimum investment requirement without adequate disclosure directly harmed retail investors by triggering large capital gains distributions. This lack of transparency and ethical oversight reflects significant shortcomings in business practices and ethical responsibility, contributing to broader systemic issues in corporate governance that can erode trust in financial institutions.

Vanguard fined more than $100 million by SEC over violations involving target date retirement funds

JAN172025

JAN172025In January 2025, Vanguard was fined over $106 million by the SEC for inadequately disclosing the potential tax implications of lowering the minimum investment threshold for its institutional target date funds. This decision, which prioritized fee revenue over investor interests, has raised concerns about the firm's business practices and ethical responsibility.

-70

Business Practices and Ethical Responsibility

March 27

The SEC fine against Vanguard highlights serious shortcomings in ethical business practices, where the firm altered investment thresholds without adequately informing retail investors. This resulted in unexpected taxable events and capital gains distributions, effectively prioritizing fee revenue over investor welfare. Such practices undermine trust and transparency, reflecting a broader trend of corporate behavior that neglects ethical responsibility in favor of profits.

Vanguard fined more than $100 million by SEC over violations involving target date retirement funds

JAN102025

JAN102025A Financial Times report has accused Vanguard, along with Fidelity Investments and JPMorgan Asset Management, of paying lip service to human rights. The report suggests that Vanguard’s investment strategies may be neglecting human rights considerations, raising serious questions about its commitment to ethical business practices and labor relations.

-50

Labor Relations and Human Rights Practices

March 27

The report alleges that Vanguard has ignored critical human rights issues, failing to take effective action in monitoring or addressing labor rights concerns within its investment portfolio. This neglect raises significant concerns about the fund's commitment to ethical practices under its business practices and ethical responsibility mandate.

Fidelity, Vanguard and JPMorgan accused of ignoring human rights

DEC012022

DEC012022In December 2022, Vanguard engaged with the SEC by submitting a comment letter on proposed equity market structure reforms aimed at enhancing investor protection and transparency. This action reflects their commitment to ethical business practices and robust public policy engagement, contributing to market fairness and democratic oversight.

+80

Public and Political Behavior

March 27

Vanguard's proactive engagement with the SEC demonstrates strong public and political behavior. By advocating for increased transparency and equitable market practices, they support policies that counteract centralization of power and potential authoritarian practices in financial markets.

+75

Business Practices and Ethical Responsibility

March 27

By pushing for regulatory reforms that prioritize investor protection and transparent market practices, Vanguard upholds robust business practices and ethical responsibility. This move aligns with values that resist exploitative and authoritarian tendencies in financial systems.

+70

Economic and Structural Influence

March 27

Vanguard’s input in the SEC’s reevaluation of market structure underscores their influential role in shaping economic governance. Their engagement helps bolster market integrity, ensuring that structural reforms serve the broader public interest and mitigate risks of authoritarian control in economic policymaking.

JUL292003

JUL292003Vanguard Group was required to pay $500,000 and implement comprehensive anti-discrimination measures following an EEOC lawsuit. The suit alleged that a black employee faced retaliation after raising concerns about racial discrimination, highlighting significant failures in upholding labor rights and ethical responsibility.

-80

Labor Relations and Human Rights Practices

March 27

The event exposes serious labor and human rights violations, where an African American employee was retaliated against after reporting race discrimination. Such practices undermine the company’s ethical responsibility and contribute indirectly to broader systems of oppression. This negative behavior is diametrically opposed to anti-fascist and progressive labor ideals.

Alternatives

Corporation

0.00

Corporation

-45.57

Toronto, Canada

7.69

Corporation

0.00

Corporation

0.00

Corporation

0.00

Corporation

0.00

Corporation

0.00

Corporation

0.00

Corporation

0.00

Industries

- 523910

- Miscellaneous Intermediation

- 525920

- Trusts, Estates, and Agency Accounts

- 523920

- Portfolio Management